Mortgage Protection Insurance is a relatively new type of insurance, specifically for homeowners, but what is it exactly? And do you need to have it? We are answering your questions about this home security insurance product so you can make an informed choice for your home and your loved ones.

Purchasing a home is likely the largest financial investment you will make in your life, and your monthly mortgage payments are probably your biggest expense. Your ability to pay your mortgage will be checked thoroughly when you make your mortgage application, but it relies on one assumption – that you will continue as you are now. If you are unable to continue earning due to ill health, your mortgage can soon become an escalating issue.

What is Mortgage Protection Insurance?

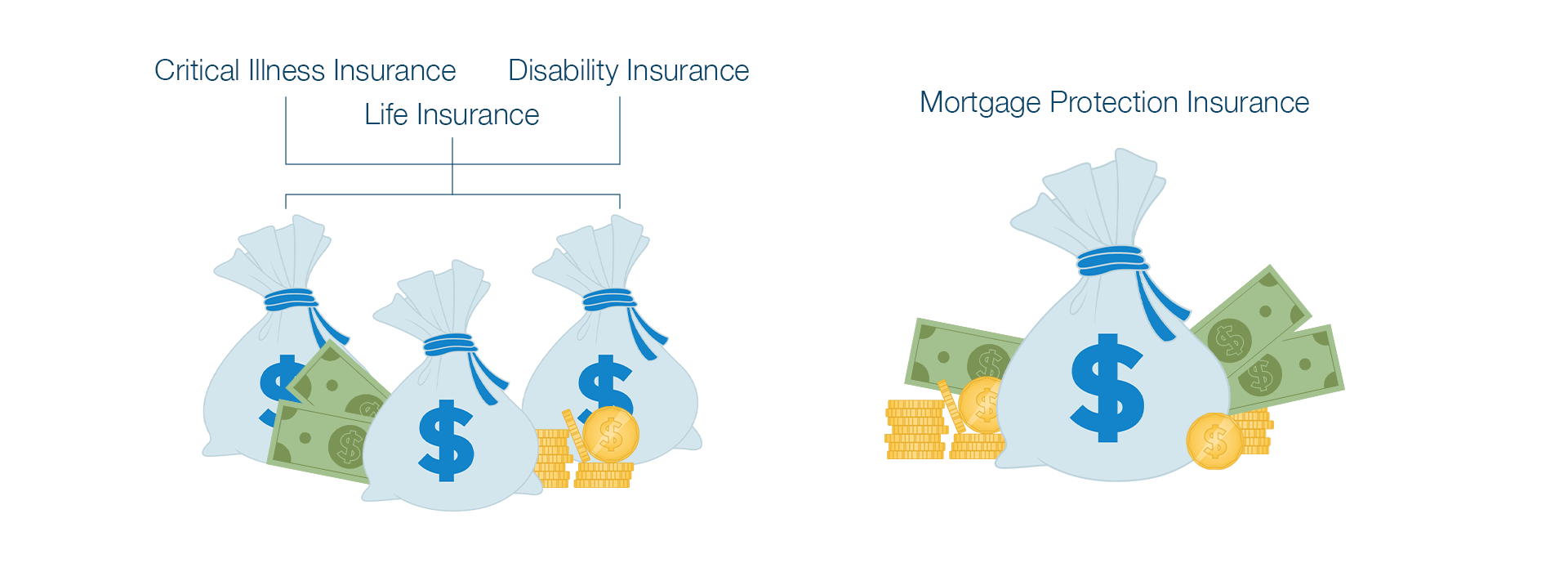

Policies can vary; we carry a product from Assumption Life that covers you for critical illness, disability, and life insurance. This umbrella product provides access to three types of coverage wrapped up in a single policy.

If you are diagnosed with a critical illness (Usually stroke, cancer, heart attack, or kidney failure), you will receive a lump sum, allowing you to pay down your mortgage or anything else you choose to spend it on.

If you become disabled before the age of 65, you will receive a monthly income replacement that may last until retirement age, easing concerns regarding mortgage payments.

And finally, should the worst happen, your life insurance coverage will pay out to your loved ones. Paid as a lump-sum, this is most commonly used to clear outstanding mortgage balances but can be used as your loved ones see fit.

What is the advantage of Mortgage Protection over separate policies?

Mortgage Protection coverage is often significantly cheaper than having separate life, critical illness, and disability policies. It also provides simplicity with only a single payment, policy to manage, and terms.

Related content:

Everything you wanted to know about critical illness insurance

Mortgage insurance vs life insurance for ultimate mortgage protection

What are the alternatives to Mortgage Protection?

If you are wondering whether mortgage protection is the right choice for you, you do have alternatives. As we’ve said, you could opt for separate policies and choose one or more policies as needed but Mortgage Protection insurance acts as a safety net and can be the difference between defaulting on your payments and knowing you have peace of mind. In the worst-case scenarios, defaulting can lead to repossession of your home, so it is essential you make the right choice on your level of coverage.

Who needs Mortgage Protection?

Mortgages are such a hefty financial commitment that there are few who wouldn’t run into difficulties should they be unable to work.

If you are a younger homeowner in good health, it may seem unlikely that you wouldn’t be able to work, but when you consider the life-changing consequences if you are unable to pay your mortgage, Mortgage Protection is a great investment!

If you are an older homeowner, your health becomes less predictable. Even those in extremely good health can be struck down with little to no warning in later life. You purchased a home for the security that it brings, and Mortgage Protection will ensure that remains true.

We’re here for you when you need us

Mortgage Protection is a great way to buy peace of mind and financial security for you and your loved ones. Whether you have existing policies or are looking to invest in a policy for the first time, our experienced team is happy to help. If you would like to discuss a Mortgage Protection policy and see how it could help you, please get in touch for a free quote or contact us directly for more information.

Blue Country Insurance – all your protection under one roof… because your health and life matters.